Products

Exporting Products

We are an import-export company in Vietnam. We export of agricultural products, handicrafts and other processed products. With a wealth of experience in production and business activities, VINASHIP is a reliable partner for domestic and international customers.

If you interested in Vietnam products, please contact us:

VINASHIP IMPORT EXPORT COMPANY LIMITED

K05-4T3, CT15, Viet Hung urban, Giang Bien ward, Long Bien Dist, Hanoi City, Vietnam

K05-4T3, CT15, Viet Hung urban, Giang Bien ward, Long Bien Dist, Hanoi City, Vietnam

+84.949.518.000

+84.949.518.000  +84.243.2020.333 Email: info@vinaship.asia

+84.243.2020.333 Email: info@vinaship.asia

B&V Coffee (Production in Vietnam - Export by Vinaship)

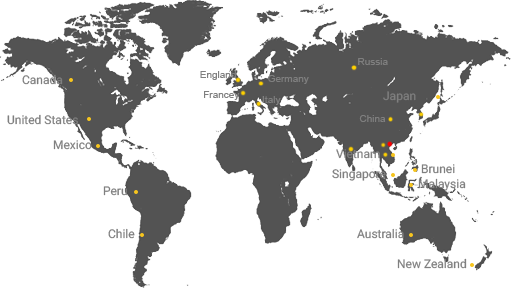

Currently, the Regional Comprehensive Economic Partnership (RCEP) is also under negotiation. When these trade agreements come into force, Vietnamese exports will be freely accessible to many of the world’s largest markets with few tariffs or restrictions.

In terms of regulatory and financial incentives, Vietnam has become increasingly investor-friendly in recent years –the government has taken such actions as reforming its financial sector, streamlining business regulations, and improving the quality of its workforce.

Vietnam is an excellent place to source products, assuming that your product can be made here. While Vietnam has a massive industrial base.If you interested in Vietnam products, please contact us by email: info@vinaship.asia

Current state of Vietnam’s economy

Vietnam is seeing strong growth on multiple fronts. Of particular interest to investors has been the continuing growth of Vietnam’s domestic consumer market, which has been developing by leaps and bounds. This growth is expected to continue for some time to come – domestic consumption is predicted to increase at a rate of 20 percent per year. With a population of over 95 million and Southeast Asia’s fastest-growing middle class, Vietnam clearly represents an important market for foreign goods.

| Export Markets | Export Value (2017) |

|---|---|

| China | US $50.37 billion |

| United States | US $48.43 billion |

| Japan | US $18.53 billion |

| Korea | US $16.18 billion |

| Germany | US $10.92 billion |

| Import Markets | Import Value (2017) |

|---|---|

| China | US $71.62 billion |

| Korea | US $47.75 billion |

| Japan | US $15.06 billion |

| Singapore | US $12.29 billion |

| Thailand | US $11.60 billion |

Industry Snapshots

While Vietnam is widely known for being a prime location for investors operating in the textile industry, there are many other business areas that are seeing significant growth in the country. Interestingly, Vietnam is well on its way to becoming a key location for high-technology manufacturing, with companies like Samsung, LG Electronics, Nokia, and Intel making multi-billion dollar investments into the country. Other business areas include information and communications technology, automotive, and medical devices.

As of 2017, Vietnam is the largest ASEAN supplier to the U.S. with a net export value of US$48.43 billion. In fact, Vietnam is likely to become the wealthiest Southeast Asian country in terms of trade. Additional statistics indicate that bilateral trade with the U.S. will surge to US$57 billion by 2020, cementing Vietnam’s prominence as a valuable hub for foreign investment.

| Top Exports | Export Value (2017) |

|---|---|

| Phones | US $45.1 billion |

| Textiles | US $25.9 billion |

| Electronic goods/Computers | US $25.9 billion |

| Footwear | US $14.6 billion |

| Machinery | US $12.8 billion |

| Top Imports | Import Value (2017) |

|---|---|

| Electronic goods/Computers | US $37.5 billion |

| Machinery | US $33.6 billion |

| Phones | US $16.2 billion |

| Fabrics | US $11.4 billion |

| Iron and steel | US $9.1 billion |

Agriculture in Vietnam

We exported lychee to China, France and upcoming to Japan

Textiles and Garments

Textiles consistently rank among Vietnam’s leading export industries, with over 6000 textiles and garments manufacturing companies, employing upwards of 2.5 million workers. The growth of the garment industry has been impressive. In Q1 2018, Vietnamese garment exports rose by 15.4 percent, with a projected growth rate for the first six months in Q2 to go up 14 percent.

China is the only nation that surpasses Vietnam in terms of net garment exports to the U.S. However, manufacturers and investors are pivoting towards Vietnam; the conditions for setting up shop are more economically convenient than doing so in China.

Within ASEAN, Vietnam is the strongest competitor for inheriting low value-added textiles and apparel manufacturing from China. In contrast to other leading textile exporters in the region (Indonesia, Thailand, Malaysia), the share of Vietnam’s textile exports against its total exports has grown in recent years.

With its rising costs, China is no longer the go-to destination for many businesses and Vietnam has

arisen as a serious competitor. Recent trends show that the number of orders shifting from China to Vietnam has seen a significant increase. |

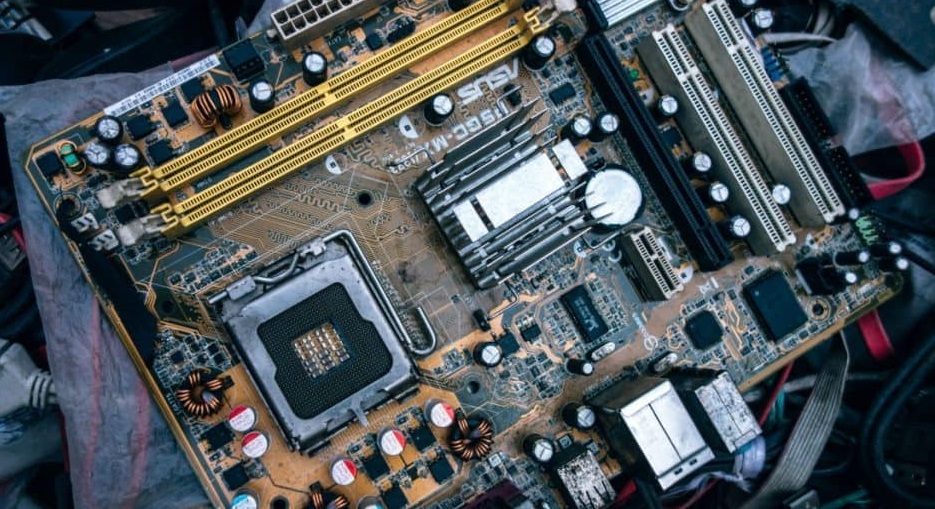

Electronics

Vietnam has emerged as an important electronics exporter, with electrical and electronic products overtaking coffee, textiles, and rice to become the country’s top export item. Samsung is Vietnam’s largest exporter and has helped the country achieve a trade surplus for the first time in many years.

Exports of smartphones and computer parts now account for more in export earnings than oil and garments. Samsung has turned Vietnam into a global manufacturing base for its products, producing almost a third of the firm’s output. Samsung has invested over US$17 billion into the country.

Samsung has also agreed to cooperate with the Vietnamese government in order to help develop the country’s domestic support industries. This represents a key business opportunity for foreign technology companies to set up operations in Vietnam and sell their components to companies like Samsung.

Pharmaceuticals

The future looks to be very interesting for the pharmaceutical industry in Vietnam. Vietnam’s pharmaceutical market has grown to US$5.2 billion in value in 2018 so far and is estimated to reach US$6.6 billion by 2020. Driving this market growth is the Vietnamese government’s goal of achieving Universal Health Coverage, combined with a growing market of consumers who want accessible healthcare.

Automotive

Vietnam is becoming an important market for auto sales: the Vietnamese automobile market is expected to sell 1.7-1.85 million units by 2035. In the foreseeable future, an estimated 750,000-800,000 units are expected to be sold by 2025. Although there was a recent decline in car sales, the government has introduced several new regulations to address the issue and boost production.

Despite an increasingly competitive auto market throughout the ASEAN region, Vietnam has stated that it intends to work aggressively to build up its own domestic auto industry. Among the key reasons for this goal is that the auto industry has the potential to create thousands of jobs for locals and create a strong system of supporting industries.

Coffee

Vietnam is poised to become the world’s largest producer and exporter of coffee. Currently, the country is the world’s second largest coffee exporter, behind only Brazil. However, many experts believe that Vietnam has the potential to overtake Brazil due to its favorable climate conditions and lower cost production.

Traditional Vietnamese coffee is made from Robusta beans, which have a strong, bitter taste.

E-commerce

Vietnam is quickly becoming a prime market for foreign investment in e-commerce activities. The country’s rapidly growing economy and middle class are, in turn, spawning a strong consumer culture and increasing levels of disposable income. Electronic retail is fast becoming the preferred method of shopping—particularly among the country’s youth.

So far in 2018, the e-commerce market has reached US$6.2 billion and is expected to hit US$10 billion by 2020, with an average spending of US$350 per capita. In 2017, internet penetration in Vietnam reached 53.86 million people and is estimated to have 59.48 million internet users by 2022.

If you interested in Vietnam products, please contact us

VINASHIP IMPORT EXPORT COMPANY LIMITED

K05-4T3, CT15, Viet Hung urban, Giang Bien ward, Long Bien Dist, Hanoi City, Vietnam

K05-4T3, CT15, Viet Hung urban, Giang Bien ward, Long Bien Dist, Hanoi City, Vietnam

+84.949.518.000

+84.949.518.000  +84.243.2020.333

+84.243.2020.333

Email: info@vinaship.asia

info@vinaship.asia

info@vinaship.asia